Two-pillar framework: how is Thailand gearing up?

HLB Thailand Transfer Pricing Team

Amit Bhalla and Urika Solano of HLB Thailand provides an update on Thailand’s progress towards implementation of BEPS 2.0 and explains why governmental agencies and multinational enterprises should undertake comprehensive reassessments

Multinational enterprises (MNEs) have increasingly embraced digital technologies by altering the landscape of commerce. These advancements have undoubtedly bolstered operational efficiencies and empowered MNEs to devise business models that allow them to conduct operations virtually without physical storefronts. This paradigm shift towards digitally driven business platforms has a consequential downside: the relocation of taxable profits from jurisdictions where economic activities originate. Also, the primary driver of profits for such digital enterprises often resides in intangible assets, which pose challenges in associating them with a specific jurisdiction.

To address such challenges arising from the digitalisation of the economy, the OECD introduced a two-pillar approach, aiming to equitably ascertain the tax base and the taxation methodology for MNEs operating in a digital world. Pillar one focuses on reallocating taxing rights, while pillar two aims to ensure a minimum level of taxation for MNEs.

The OECD’s ‘blueprints’ on the two-pillar approach focus on nexus and profit allocations and BEPS challenges. Given the set of methodologies proposed to functionalise the two-pillar approach, it is clear that it requires tax administrations to look beyond the arm’s-length principle by shifting their focus from relying on functions, assets, and risks analysis to functions, assets, risks, and market analysis. So far, about 140 jurisdictions, including Thailand, have endorsed the OECD's BEPS 2.0 initiative.

Thailand’s draft law on pillar two

In March 2024, the Thai Revenue Department (TRD) initiated a public consultation regarding the draft law on the pillar two scheme. The proposed legislation lays out the framework to establish a minimum tax rate for MNEs, enabling the collection of top-up taxes following the global anti-base erosion (GloBE) rules.

Under the aforesaid draft, top-up tax is categorised as assessed tax and is distinct from income tax. The TRD will be tasked with the responsibility of collecting this top-up tax. The draft law will apply to members of MNEs in Thailand with consolidated annual revenues of at least €750 million (approximately THB 29.7 billion).

In line with the OECD’s recommendations, government agencies, international organisations, non-profit organisations, pension funds, etc. are excluded from the draft law on the pillar two scheme.

Determination of the top-up tax

The computation of the jurisdictional top-up tax percentage, along with mechanisms for determining the top-up tax amount in the draft law for Thailand, follows the OECD model rules.

The jurisdictional top-up tax percentage is proposed to be computed by applying the top-up tax percentage to jurisdictional excess profit, which is subsequently adjusted to include any additional current top-up tax that arises on account of special circumstances and excludes the jurisdiction’s qualified domestic minimum top-up tax (QDMTT).

The jurisdictional top-up tax percentage is determined by deducting the jurisdictional effective tax rate (ETR) from the minimum rate of 15%. The jurisdictional excess profit is computed by subtracting the substance-based income exclusion from the net GloBE income of a jurisdiction.

However, the draft legislation did not outline a complete mechanism for determining the top-up tax, along with the detailed adjustments to be made in this regard, which will be addressed in additional ministerial regulations. Furthermore, the draft refers to three GloBE rules for determining top-up tax liability and the charging mechanism for the allocation of top-up tax:

- QDMTT – all Thai constituent entities will be subject to the top-up tax under the QDMTT if Thailand's ETR falls below the global minimum tax rate of 15%.

- Income inclusion rule (IIR) – Thai ultimate parent entities’ intermediate parent entity/entities, or any partially owned parent entities (as the case may be), will be subject to the top-up tax under the IIR if one or more foreign jurisdictions in which they have direct and indirect ownership are considered to be low-taxed jurisdictions (i.e., where the ETR falls below 15%).

- Undertaxed payment rule (UTPR) – all Thai constituent entities will be subject to the top-up tax under the UTPR if the top-up tax of a low-taxed constituent entity (LTCE) has not been paid, or fully paid, under the QDMTT or the qualified IIR, in such LTCE. As against OECD’s recommendations, the draft legislation provides that Thailand will not employ a denial of deduction approach for the UTPR mechanism. On the contrary, the additional top-up tax will be levied on all Thai constituent entities.

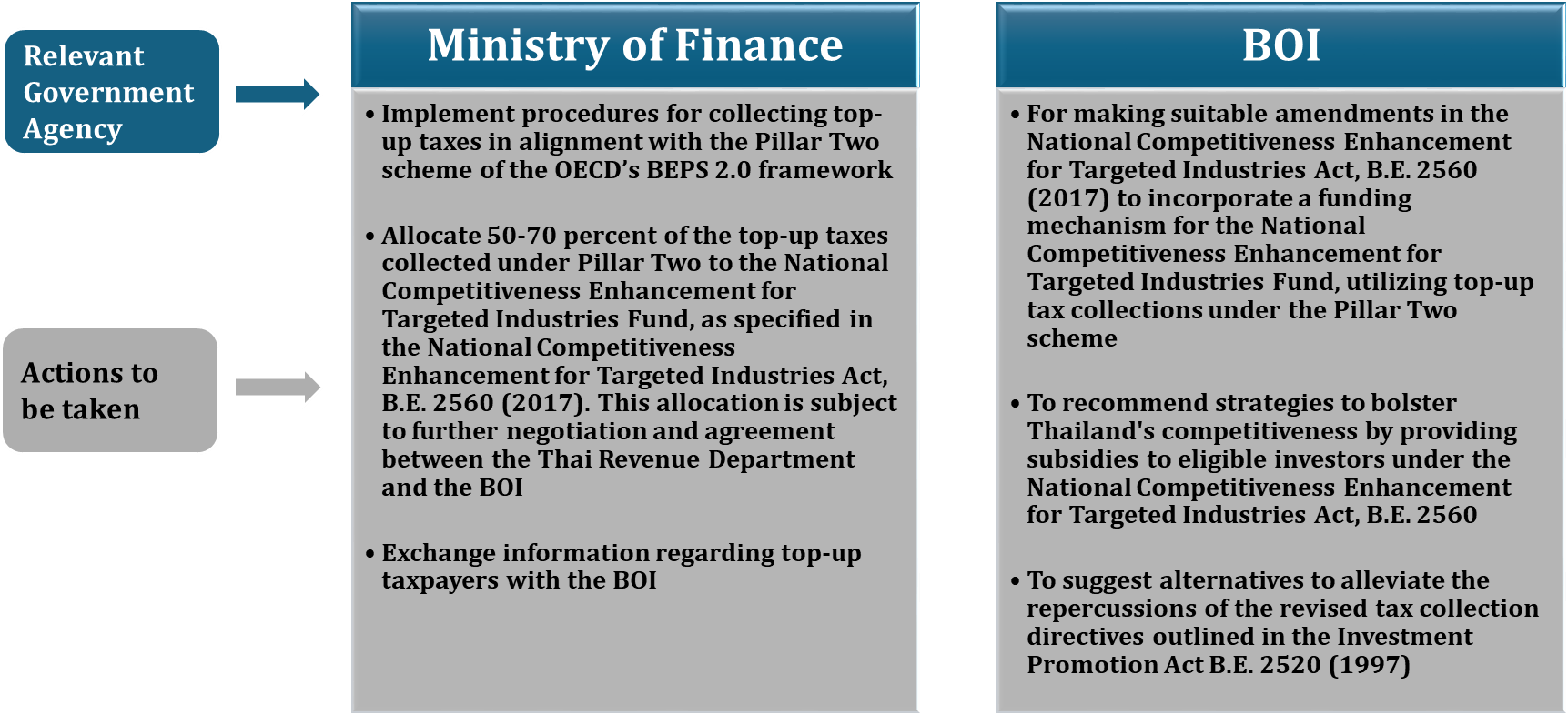

Additional steps taken by the Thai Cabinet

The Thai Cabinet approved measures to incorporate the global minimum tax regulations and tasked the Thailand Board of Investment (BOI) and the Ministry of Finance to carry out relevant actions. It is important to note that the pillar one scheme has not been included in the Cabinet’s approved measures and the pillar two scheme has been approved, which applies a minimum tax rate of 15% for each jurisdiction in which an MNE operates, with a top-up tax to be paid in the event that the ETR in a jurisdiction falls below the minimum.

The BOI has outlined new measures to enable qualified BOI-promoted companies, currently benefiting from BOI income tax exemption incentives, to choose to apply 50% of the statutory corporate income tax (CIT) rate, which is presently 20%. Consequently, they can opt for a reduced CIT rate of 10% for the remaining tax exemption period. By selecting the 10% CIT rate instead of the income tax exemption, BOI companies extend their tax incentive period by the duration of the remaining tax exemption period.

The 10% CIT rate option is capped at a maximum of 10 years, encompassing an initial five-year period granted to certain taxpayers under a BOI incentive that allows for a five-year 50% CIT rate reduction following the expiry of the tax exemption period. This option also applies analogously to new BOI investment-promoted projects for eligible BOI-promoted companies.

Compliance requirements and penal provisions

The compliance requirements and potential penalties outlined in the draft law for taxpayers falling within its scope in Thailand include an obligation to submit detailed information on the MNE group, the GloBE information return, the top-up tax information return, and the top-up tax payment to the TRD within 15 months from the end of the reporting fiscal year. The statute of limitations for the top-up tax is 10 years from the filing date.

There is a 100% penalty for a tax shortfall for incorrect filing and a 200% penalty for failure to file. Additionally, failure to make a payment or making an incomplete payment would result in an additional monthly 1.5% surcharge. The law is planned to be effective in 2025.

Key takeaways

To keep its tax practice in sync with the world, Thailand should undertake a comprehensive assessment of the impact of the adoption of the GloBE rules on the tax incentives offered under the current tax laws. A revamping of its tax incentive policies to align with the GloBE rules may be required, simultaneously creating greater business opportunities for MNEs to operate in Thailand vis-à-vis other countries. Also, the TRD, the Ministry of Finance, and the BoI should collectively evaluate whether the pillar two measures are beneficial for long-term economic growth.

Furthermore, MNE groups should re-evaluate alternative investment locations, restructuring plans, and tax strategies at a global level, given that pillar two’s objective is to discourage MNEs from restructuring/setting up their business in low-tax jurisdictions to avoid/reduce tax liability at a global level.

Related content